Featured

Table of Contents

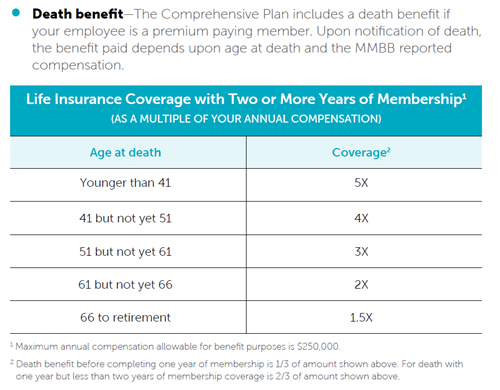

Insurance provider won't pay a small. Rather, consider leaving the cash to an estate or trust fund. For even more comprehensive info on life insurance policy get a duplicate of the NAIC Life Insurance Policy Purchasers Overview.

The internal revenue service places a limitation on exactly how much cash can enter into life insurance policy costs for the policy and exactly how rapidly such premiums can be paid in order for the plan to keep every one of its tax benefits. If specific restrictions are gone beyond, a MEC results. MEC policyholders may be subject to tax obligations on distributions on an income-first basis, that is, to the level there is gain in their policies, along with penalties on any taxable amount if they are not age 59 1/2 or older.

Please note that impressive loans accumulate interest. Income tax-free treatment likewise presumes the loan will become pleased from income tax-free survivor benefit profits. Car loans and withdrawals reduce the policy's cash money value and survivor benefit, might trigger specific policy benefits or riders to end up being unavailable and might boost the opportunity the plan may lapse.

4 This is provided through a Long-lasting Treatment Servicessm rider, which is offered for an added fee. In addition, there are limitations and restrictions. A customer may get approved for the life insurance policy, but not the cyclist. It is paid as a velocity of the survivor benefit. A variable global life insurance policy agreement is an agreement with the main purpose of providing a survivor benefit.

What is the difference between Term Life and other options?

These profiles are closely handled in order to satisfy stated financial investment objectives. There are charges and charges linked with variable life insurance policy agreements, consisting of mortality and danger costs, a front-end load, management costs, financial investment monitoring charges, abandonment charges and costs for optional riders. Equitable Financial and its associates do not give legal or tax suggestions.

Whether you're starting a family or marrying, individuals usually start to consider life insurance when someone else begins to depend on their capability to gain an earnings. Which's great, because that's precisely what the death advantage is for. As you discover much more concerning life insurance coverage, you're likely to locate that several policies for circumstances, entire life insurance policy have greater than just a survivor benefit.

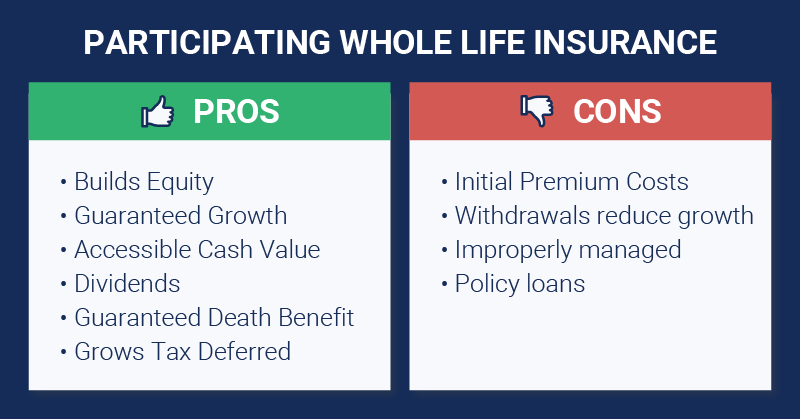

What are the benefits of entire life insurance coverage? One of the most appealing benefits of acquiring an entire life insurance coverage policy is this: As long as you pay your costs, your fatality advantage will certainly never expire.

Assume you don't need life insurance if you don't have kids? There are numerous advantages to having life insurance coverage, also if you're not sustaining a family.

What are the top Living Benefits providers in my area?

Funeral expenditures, funeral prices and clinical costs can accumulate (Premium plans). The last point you want is for your liked ones to bear this additional burden. Long-term life insurance policy is readily available in numerous amounts, so you can pick a fatality advantage that satisfies your requirements. Alright, this one only uses if you have youngsters.

Figure out whether term or irreversible life insurance policy is right for you. As your individual scenarios change (i.e., marital relationship, birth of a kid or job promotion), so will certainly your life insurance needs.

For the a lot of part, there are two types of life insurance policy intends - either term or permanent strategies or some combination of the 2. Life insurance firms supply various types of term plans and traditional life plans along with "rate of interest sensitive" items which have actually become extra prevalent given that the 1980's.

Term insurance offers protection for a specified time period. This period might be as short as one year or offer protection for a certain variety of years such as 5, 10, 20 years or to a defined age such as 80 or in many cases as much as the oldest age in the life insurance policy mortality.

What are the top Universal Life Insurance providers in my area?

Currently term insurance coverage rates are really affordable and amongst the most affordable historically skilled. It needs to be noted that it is a widely held belief that term insurance policy is the least pricey pure life insurance coverage readily available. One requires to examine the policy terms carefully to make a decision which term life choices are suitable to meet your particular conditions.

With each new term the costs is boosted. The right to renew the policy without evidence of insurability is a crucial benefit to you. Otherwise, the danger you take is that your health may wear away and you might be unable to acquire a policy at the same rates or also in any way, leaving you and your recipients without insurance coverage.

You should exercise this alternative throughout the conversion duration. The length of the conversion period will certainly vary depending on the kind of term policy acquired. If you transform within the proposed period, you are not called for to offer any information about your health. The premium rate you pay on conversion is usually based on your "current achieved age", which is your age on the conversion day.

Under a level term policy the face amount of the plan stays the exact same for the whole period. Commonly such plans are marketed as mortgage security with the amount of insurance policy lowering as the balance of the mortgage decreases.

Cash Value Plans

Typically, insurance companies have actually not deserved to transform costs after the policy is sold. Given that such plans might continue for years, insurance firms must make use of conservative mortality, passion and cost price estimates in the costs estimation. Adjustable costs insurance, nevertheless, enables insurers to offer insurance coverage at lower "existing" costs based upon much less traditional presumptions with the right to change these costs in the future.

While term insurance coverage is created to offer security for a specified amount of time, irreversible insurance is made to provide protection for your entire life time. To keep the premium rate level, the premium at the younger ages exceeds the real price of security. This additional premium develops a book (cash worth) which assists spend for the plan in later years as the cost of security increases above the premium.

Under some policies, costs are called for to be spent for a set number of years. Under various other plans, premiums are paid throughout the insurance policy holder's lifetime. The insurer invests the excess costs dollars This type of plan, which is sometimes called cash money worth life insurance, creates a cost savings component. Cash money worths are crucial to a permanent life insurance policy plan.

Latest Posts

End Of Life Insurance For Seniors

Life Insurance Quote Instantly

Funeral Coverage Insurance