Featured

Table of Contents

- – How do I choose the right Level Term Life Insu...

- – What is the best Low Cost Level Term Life Insu...

- – What is the best Level Term Life Insurance Pr...

- – What is the best Best Value Level Term Life I...

- – What are the benefits of Level Term Life Ins...

- – Who provides the best What Is Level Term Lif...

Term life insurance is a type of plan that lasts a particular size of time, called the term. You choose the size of the policy term when you initially take out your life insurance coverage.

Pick your term and your quantity of cover. Select the policy that's right for you., you know your costs will certainly remain the very same throughout the term of the plan.

How do I choose the right Level Term Life Insurance For Young Adults?

Life insurance coverage covers most circumstances of death, but there will certainly be some exclusions in the terms of the plan - Best value level term life insurance.

After this, the policy finishes and the making it through companion is no longer covered. Joint plans are normally much more budget-friendly than single life insurance coverage plans.

This safeguards the buying power of your cover quantity versus inflationLife cover is an excellent thing to have due to the fact that it provides economic protection for your dependents if the most awful takes place and you die. Your liked ones can also utilize your life insurance policy payout to spend for your funeral. Whatever they pick to do, it's great assurance for you.

Nonetheless, degree term cover is great for meeting daily living expenses such as family bills. You can also utilize your life insurance benefit to cover your interest-only mortgage, payment home loan, college fees or any kind of various other financial obligations or continuous settlements. On the various other hand, there are some drawbacks to level cover, contrasted to other types of life plan.

What is the best Low Cost Level Term Life Insurance option?

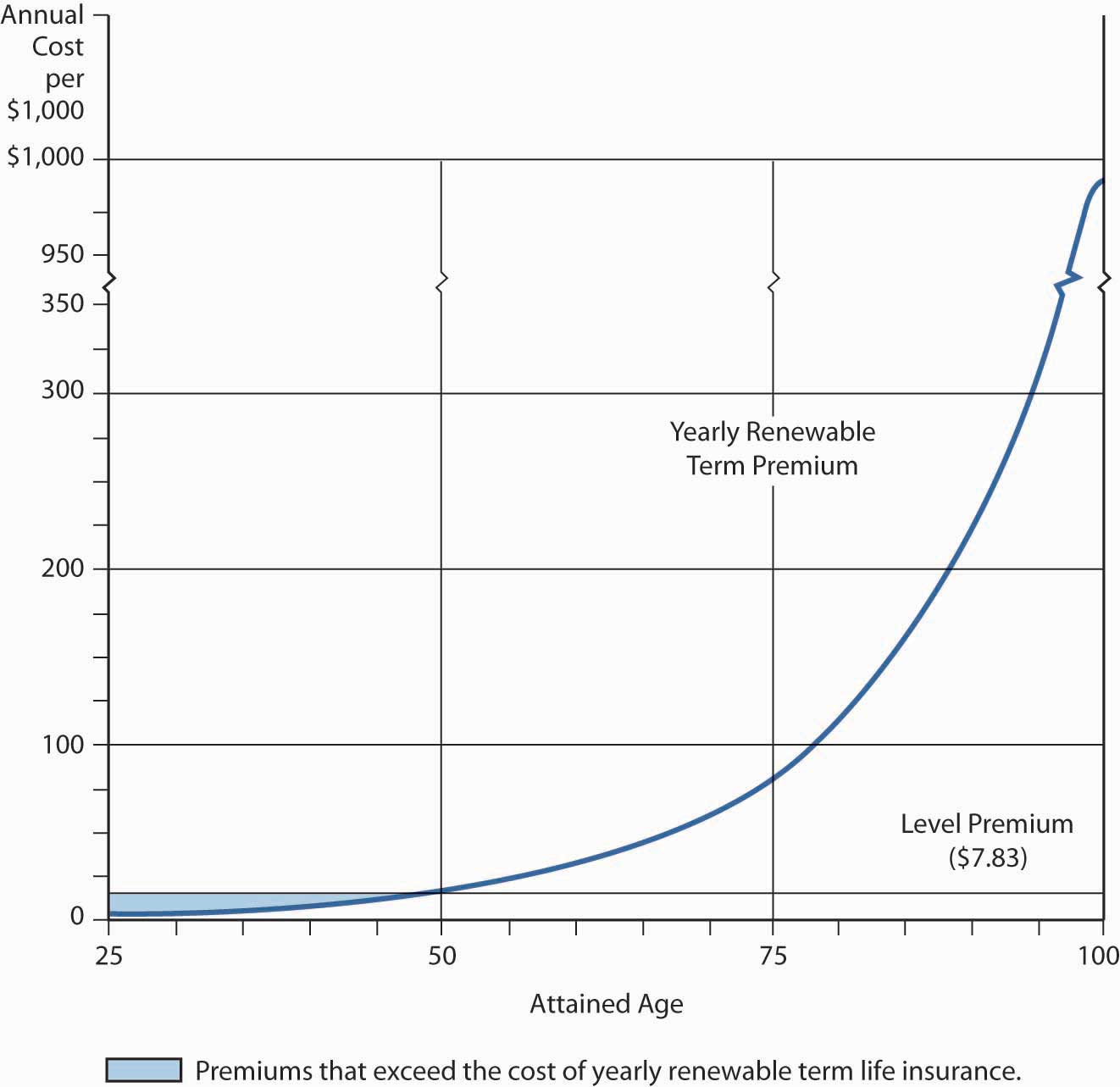

Words "degree" in the phrase "level term insurance coverage" implies that this kind of insurance has a set costs and face quantity (fatality advantage) throughout the life of the policy. Basically, when individuals speak about term life insurance, they normally refer to degree term life insurance policy. For the bulk of individuals, it is the most basic and most affordable selection of all life insurance policy types.

Words "term" below refers to an offered variety of years during which the level term life insurance policy stays energetic. Level term life insurance policy is among one of the most preferred life insurance plans that life insurance policy companies offer to their clients as a result of its simpleness and affordability. It is additionally very easy to compare degree term life insurance policy quotes and obtain the very best premiums.

The system is as complies with: First of all, pick a plan, survivor benefit quantity and policy period (or term size). Choose to pay on either a monthly or yearly basis. If your early death happens within the life of the policy, your life insurance company will pay a swelling sum of death advantage to your predetermined beneficiaries.

What is the best Level Term Life Insurance Premiums option?

Your degree term life insurance coverage policy expires as soon as you come to the end of your plan's term. At this point, you have the adhering to choices: Option A: Keep without insurance. This option suits you when you can insure by yourself and when you have no financial obligations or dependents. Choice B: Acquire a new degree term life insurance coverage plan.

FOR FINANCIAL PROFESSIONALS We have actually made to provide you with the very best online experience. Your current internet browser might limit that experience. You might be making use of an old web browser that's unsupported, or settings within your internet browser that are not suitable with our website. Please save yourself some stress, and upgrade your internet browser in order to watch our website.

What is the best Best Value Level Term Life Insurance option?

Already using an upgraded browser and still having trouble? Your existing internet browser: Spotting ...

If the policy expires plan runs out death or fatality live beyond the policy termPlan there is no payout. You might be able to restore a term plan at expiration, however the costs will be recalculated based on your age at the time of renewal.

As you can see, the very same 30-year-old healthy and balanced male would certainly pay approximately $282 a month. At 50, he would certainly pay $571. Whole Life Insurance Rates 30 $282 $247 40 $382 $352 50 $571 $498 60 $887 $782 Source: Quotacy. Quotes are for a $500,000 long-term life insurance policy plan, for men and ladies in superb health and wellness.

What are the benefits of Level Term Life Insurance Rates?

That reduces the overall risk to the insurance firm contrasted to an irreversible life policy. The lowered threat is one element that allows insurers to charge lower premiums. Rate of interest prices, the financials of the insurer, and state laws can also influence premiums. As a whole, business usually supply much better prices at the "breakpoint" insurance coverage levels of $100,000, $250,000, $500,000, and $1,000,000.

:max_bytes(150000):strip_icc()/dotdash-ask-answers-205-Final-7a1ca51b85d44e0d81dc7b46f919180d.jpg)

Inspect our referrals for the finest term life insurance policy policies when you prepare to acquire. Thirty-year-old George wishes to secure his family members in the not likely event of his early fatality. He acquires a 10-year, $500,000 term life insurance coverage policy with a costs of $50 per month. If George passes away within the 10-year term, the policy will pay George's beneficiary $500,000.

If he continues to be to life and restores the plan after ten years, the premiums will certainly be greater than his first plan since they will be based on his existing age of 40 instead of 30. Affordable level term life insurance. If George is detected with a terminal ailment during the very first policy term, he most likely will not be qualified to restore the plan when it expires

There are numerous kinds of term life insurance. The finest option will depend on your specific circumstances. Most term life insurance policy has a degree premium, and it's the kind we've been referring to in many of this article.

Who provides the best What Is Level Term Life Insurance??

Hence, the premiums can come to be prohibitively pricey as the insurance policy holder ages. Yet they may be a great alternative for a person that needs short-term insurance coverage. These policies have a survivor benefit that decreases annually according to an established timetable. The insurance holder pays a fixed, degree costs for the period of the policy.

Table of Contents

- – How do I choose the right Level Term Life Insu...

- – What is the best Low Cost Level Term Life Insu...

- – What is the best Level Term Life Insurance Pr...

- – What is the best Best Value Level Term Life I...

- – What are the benefits of Level Term Life Ins...

- – Who provides the best What Is Level Term Lif...

Latest Posts

End Of Life Insurance For Seniors

Life Insurance Quote Instantly

Funeral Coverage Insurance

More

Latest Posts

End Of Life Insurance For Seniors

Life Insurance Quote Instantly

Funeral Coverage Insurance