Featured

Table of Contents

A level term life insurance policy policy can offer you assurance that individuals that rely on you will certainly have a fatality advantage throughout the years that you are planning to support them. It's a means to help deal with them in the future, today. A degree term life insurance policy (in some cases called level costs term life insurance coverage) plan offers protection for an established variety of years (e.g., 10 or twenty years) while maintaining the premium payments the very same for the duration of the policy.

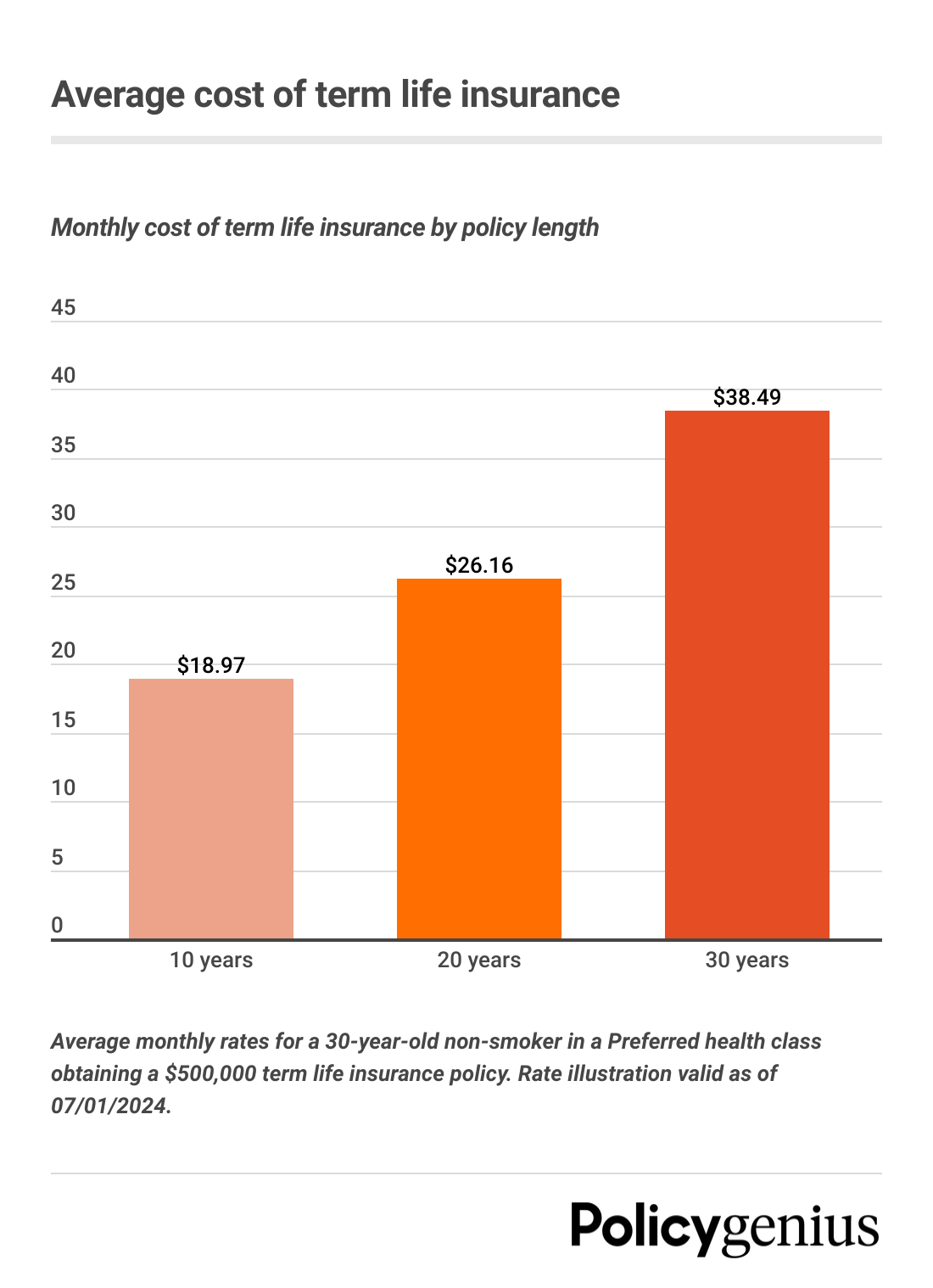

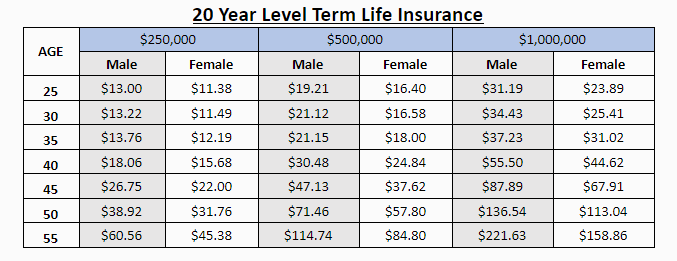

With level term insurance policy, the cost of the insurance will remain the exact same (or potentially decrease if returns are paid) over the term of your plan, normally 10 or 20 years. Unlike long-term life insurance policy, which never expires as lengthy as you pay premiums, a level term life insurance policy policy will certainly finish at some time in the future, commonly at the end of the duration of your degree term.

What is What Is Level Term Life Insurance Coverage?

As a result of this, many individuals use long-term insurance policy as a secure financial preparation device that can serve several demands. You may have the ability to transform some, or all, of your term insurance coverage during a set period, commonly the very first ten years of your plan, without needing to re-qualify for protection also if your wellness has actually altered.

As it does, you may want to contribute to your insurance coverage in the future. When you initially get insurance, you might have little financial savings and a big mortgage. Ultimately, your savings will certainly expand and your home loan will certainly shrink. As this occurs, you may intend to at some point minimize your fatality advantage or take into consideration transforming your term insurance policy to a permanent plan.

So long as you pay your premiums, you can rest simple knowing that your liked ones will receive a death advantage if you die during the term. Several term policies enable you the capacity to transform to permanent insurance without having to take an additional health and wellness test. This can allow you to make use of the added advantages of a long-term plan.

Degree term life insurance is just one of the most convenient courses into life insurance policy, we'll go over the advantages and drawbacks to ensure that you can select a plan to fit your demands. Level term life insurance coverage is one of the most common and basic type of term life. When you're trying to find momentary life insurance policy plans, level term life insurance coverage is one route that you can go.

You'll load out an application that consists of general individual information such as your name, age, etc as well as an extra detailed set of questions about your medical history.

The brief solution is no. A level term life insurance policy does not develop money value. If you're wanting to have a policy that you have the ability to withdraw or obtain from, you may check out irreversible life insurance policy. Entire life insurance plans, for instance, let you have the convenience of death benefits and can accumulate cash money worth with time, implying you'll have extra control over your advantages while you're alive.

Is Guaranteed Level Term Life Insurance the Right Fit for You?

Bikers are optional stipulations included in your policy that can give you fringe benefits and securities. Riders are an excellent means to add safeguards to your plan. Anything can happen throughout your life insurance term, and you wish to be ready for anything. By paying just a little bit much more a month, cyclists can offer the assistance you require in case of an emergency.

There are circumstances where these advantages are constructed right into your policy, but they can likewise be readily available as a different enhancement that needs added settlement.

Latest Posts

End Of Life Insurance For Seniors

Life Insurance Quote Instantly

Funeral Coverage Insurance