Featured

Table of Contents

When life stops, the bereaved have no option however to keep relocating. Almost promptly, family members have to manage the difficult logistics of fatality following the loss of a loved one.

On top of that, a complete death advantage is often offered unintentional death. A customized death benefit returns costs typically at 10% rate of interest if death happens in the very first 2 years and entails the most unwinded underwriting. The full death advantage is usually attended to unexpected fatality. The majority of sales are performed in person, and the market fad is to approve a digital or voice signature, with point-of-sale decisions collected and recorded through a laptop computer or tablet computer.

To underwrite this company, companies count on personal health interviews or third-party information such as prescription histories, fraudulence checks, or car documents. Underwriting tele-interviews and prescription histories can commonly be made use of to aid the representative complete the application procedure. Historically companies count on telephone interviews to verify or verify disclosure, however more recently to boost consumer experience, firms are depending on the third-party data indicated over and providing instant decisions at the factor of sale without the interview.

What Is Funeral Insurance

What is final expense insurance, and is it constantly the best path forward? Below, we take an appearance at just how final cost insurance works and elements to consider before you get it.

Yet while it is explained as a plan to cover last expenditures, recipients that obtain the survivor benefit are not required to use it to pay for final expenditures they can use it for any objective they such as. That's since last expense insurance policy actually comes under the classification of customized entire life insurance policy or simplified problem life insurance policy, which are normally entire life policies with smaller survivor benefit, frequently between $2,000 and $20,000.

Our opinions are our very own. Funeral insurance policy is a life insurance policy that covers end-of-life expenses.

Final Expense Quotes Online

Burial insurance policy requires no medical examination, making it available to those with clinical problems. This is where having burial insurance, additionally recognized as last cost insurance, comes in useful.

Simplified concern life insurance policy calls for a health and wellness assessment. If your wellness standing invalidates you from conventional life insurance coverage, funeral insurance policy might be a choice.

, interment insurance coverage comes in several forms. This policy is best for those with mild to moderate health conditions, like high blood pressure, diabetes, or asthma. If you don't want a clinical test yet can qualify for a streamlined problem plan, it is typically a much better offer than a guaranteed problem policy due to the fact that you can obtain more protection for a cheaper costs.

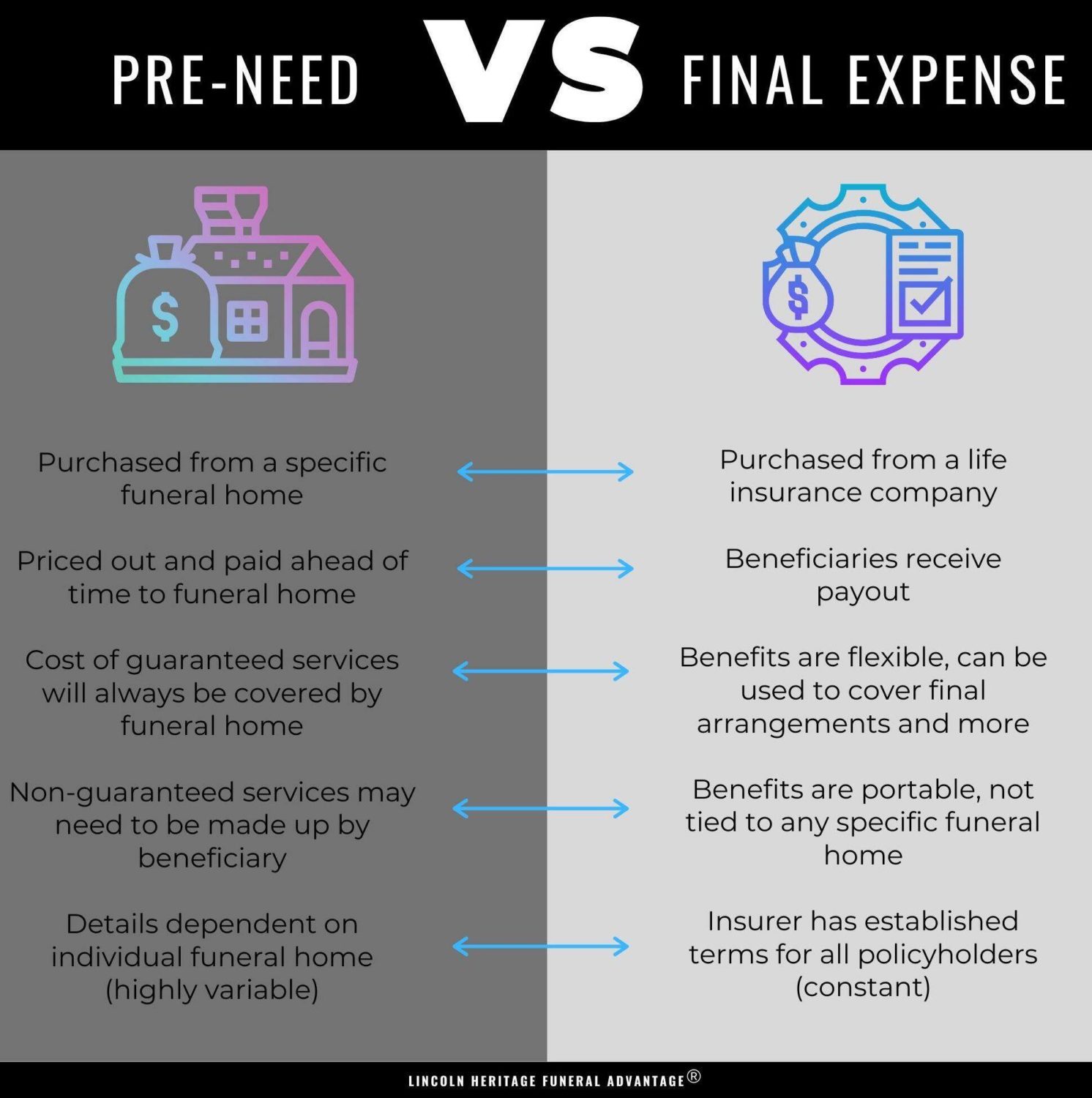

Pre-need insurance policy is high-risk because the recipient is the funeral chapel and protection specifies to the chosen funeral home. Ought to the funeral chapel fail or you vacate state, you might not have protection, which defeats the objective of pre-planning. Furthermore, according to the AARP, the Funeral Consumers Alliance (FCA) suggests against purchasing pre-need.

Those are essentially burial insurance plans. For ensured life insurance, premium estimations depend on your age, gender, where you live, and coverage quantity.

Interment insurance offers a simplified application for end-of-life protection. Most insurance provider require you to talk with an insurance policy agent to obtain a policy and acquire a quote. The insurance agents will request for your individual info, get in touch with information, economic info, and protection choices. If you choose to acquire a guaranteed concern life policy, you will not need to undergo a medical examination or survey.

The goal of living insurance coverage is to alleviate the burden on your enjoyed ones after your loss. If you have an additional funeral service policy, your liked ones can use the funeral policy to manage last costs and get an instant disbursement from your life insurance to deal with the home mortgage and education expenses.

Individuals that are middle-aged or older with medical problems may think about interment insurance, as they might not get conventional plans with more stringent authorization requirements. Furthermore, funeral insurance can be helpful to those without comprehensive financial savings or traditional life insurance policy coverage. Funeral insurance policy differs from various other sorts of insurance policy because it uses a reduced fatality advantage, typically just enough to cover expenditures for a funeral and various other associated prices.

Funeral Life Insurance For Seniors

Information & Globe Report. ExperienceAlani has examined life insurance policy and pet dog insurance provider and has created various explainers on travel insurance coverage, credit history, financial debt, and home insurance policy. She is enthusiastic regarding debunking the complexities of insurance and other individual money topics to make sure that readers have the information they need to make the most effective money decisions.

Final expenditure life insurance has a number of benefits. Last expenditure insurance policy is frequently advised for seniors that might not certify for standard life insurance due to their age.

In addition, last expenditure insurance policy is helpful for people who wish to spend for their very own funeral service. Funeral and cremation services can be pricey, so final expense insurance gives assurance understanding that your enjoyed ones will not have to utilize their cost savings to spend for your end-of-life setups. Nonetheless, last cost insurance coverage is not the best item for everybody.

Instant Life Funeral Cover

You can take a look at Values' overview to insurance at different ages if you need help deciding what kind of life insurance policy is best for your phase in life. Obtaining entire life insurance policy via Principles fasts and very easy. Protection is offered for elders in between the ages of 66-85, and there's no medical examination needed.

Based upon your feedbacks, you'll see your estimated price and the quantity of insurance coverage you get (between $1,000-$30,000). You can buy a plan online, and your insurance coverage begins quickly after paying the first costs. Your price never alters, and you are covered for your whole life time, if you continue making the monthly settlements.

At some point, we all need to consider exactly how we'll pay for an enjoyed one's, or perhaps our own, end-of-life costs. When you offer final expenditure insurance coverage, you can supply your customers with the comfort that includes knowing they and their family members are prepared for the future. You can additionally obtain an opportunity to optimize your publication of company and produce a brand-new earnings stream! Ready to learn every little thing you require to understand to start selling final expenditure insurance policy successfully? No one likes to assume concerning their own fatality, however the fact of the matter is funeral services and funerals aren't economical.

Additionally, customers for this kind of plan can have extreme legal or criminal backgrounds. It's important to keep in mind that different providers use an array of issue ages on their assured concern policies as low as age 40 or as high as age 80. Some will likewise offer greater stated value, up to $40,000, and others will certainly allow for better fatality advantage problems by enhancing the rate of interest price with the return of costs or reducing the number of years till a full death advantage is available.

Latest Posts

End Of Life Insurance For Seniors

Life Insurance Quote Instantly

Funeral Coverage Insurance