Featured

Table of Contents

Insurer won't pay a small. Rather, think about leaving the money to an estate or trust fund. For even more extensive details on life insurance policy obtain a copy of the NAIC Life Insurance Policy Customers Guide.

The internal revenue service puts a limit on just how much money can go into life insurance premiums for the plan and how promptly such premiums can be paid in order for the plan to retain every one of its tax advantages. If certain restrictions are gone beyond, a MEC results. MEC policyholders may be subject to tax obligations on circulations on an income-first basis, that is, to the extent there is gain in their plans, as well as charges on any taxed quantity if they are not age 59 1/2 or older.

Please note that outstanding financings accumulate interest. Income tax-free therapy likewise thinks the financing will ultimately be pleased from earnings tax-free death benefit profits. Financings and withdrawals decrease the plan's cash money value and fatality advantage, may cause particular policy benefits or bikers to come to be unavailable and may raise the chance the policy might gap.

4 This is supplied with a Long-lasting Care Servicessm biker, which is readily available for a surcharge. Additionally, there are constraints and constraints. A customer might receive the life insurance policy, however not the motorcyclist. It is paid as a velocity of the survivor benefit. A variable global life insurance agreement is an agreement with the key purpose of giving a fatality advantage.

How can I secure Whole Life Insurance quickly?

These profiles are carefully handled in order to satisfy stated financial investment purposes. There are costs and charges associated with variable life insurance policy agreements, including mortality and danger charges, a front-end tons, management charges, investment administration costs, abandonment charges and fees for optional riders. Equitable Financial and its affiliates do not supply lawful or tax obligation guidance.

And that's great, since that's specifically what the fatality advantage is for.

What are the benefits of whole life insurance? Here are some of the key things you need to know. One of the most enticing benefits of acquiring an entire life insurance coverage plan is this: As long as you pay your costs, your death advantage will certainly never expire. It is guaranteed to be paid no matter when you die, whether that's tomorrow, in five years, 80 years or perhaps further away. Whole life insurance.

Think you don't require life insurance coverage if you do not have youngsters? There are several advantages to having life insurance, even if you're not supporting a family.

Who offers Family Protection?

Funeral costs, funeral costs and medical expenses can build up (Long term care). The last thing you want is for your enjoyed ones to bear this added worry. Long-term life insurance policy is readily available in various amounts, so you can pick a fatality advantage that meets your requirements. Alright, this set only uses if you have children.

Establish whether term or permanent life insurance coverage is right for you. Obtain a quote of how much insurance coverage you might need, and exactly how much it might set you back. Locate the correct amount for your spending plan and satisfaction. Locate your amount. As your individual situations change (i.e., marital relationship, birth of a youngster or work promo), so will certainly your life insurance policy needs.

For the a lot of part, there are 2 types of life insurance coverage intends - either term or long-term strategies or some combination of the two. Life insurers use various forms of term strategies and typical life policies in addition to "rate of interest sensitive" items which have come to be much more widespread because the 1980's.

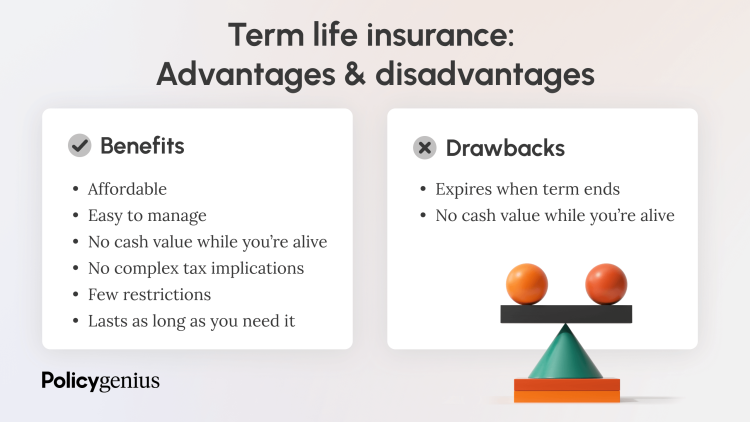

Term insurance policy offers security for a specific amount of time. This duration could be as brief as one year or give coverage for a details number of years such as 5, 10, 20 years or to a specified age such as 80 or in some instances approximately the oldest age in the life insurance policy death tables.

How can Beneficiaries protect my family?

Presently term insurance policy prices are extremely competitive and among the most affordable traditionally skilled. It must be noted that it is a commonly held idea that term insurance policy is the least pricey pure life insurance policy coverage offered. One needs to evaluate the plan terms thoroughly to choose which term life options are suitable to meet your particular situations.

With each brand-new term the premium is raised. The right to restore the plan without proof of insurability is a crucial benefit to you. Otherwise, the threat you take is that your health might weaken and you might be not able to obtain a policy at the same prices and even in all, leaving you and your recipients without coverage.

The size of the conversion duration will differ depending on the kind of term plan purchased. The costs rate you pay on conversion is normally based on your "current obtained age", which is your age on the conversion day.

Under a degree term plan the face quantity of the plan stays the exact same for the whole duration. Typically such plans are offered as home loan defense with the quantity of insurance coverage reducing as the equilibrium of the home mortgage reduces.

Is Whole Life Insurance worth it?

Traditionally, insurance companies have actually not had the right to change costs after the plan is marketed. Since such policies might continue for several years, insurance companies must use traditional death, interest and expense rate quotes in the premium computation. Adjustable premium insurance policy, however, allows insurers to provide insurance policy at lower "existing" premiums based upon much less traditional assumptions with the right to alter these costs in the future.

While term insurance policy is designed to supply protection for a defined time period, irreversible insurance policy is designed to offer coverage for your whole lifetime. To maintain the premium rate level, the premium at the more youthful ages goes beyond the real expense of defense. This extra premium constructs a reserve (cash money value) which assists spend for the plan in later years as the cost of protection increases over the premium.

The insurance policy firm invests the excess premium dollars This kind of policy, which is sometimes called money value life insurance policy, creates a cost savings component. Cash values are critical to a long-term life insurance coverage policy.

Latest Posts

End Of Life Insurance For Seniors

Life Insurance Quote Instantly

Funeral Coverage Insurance